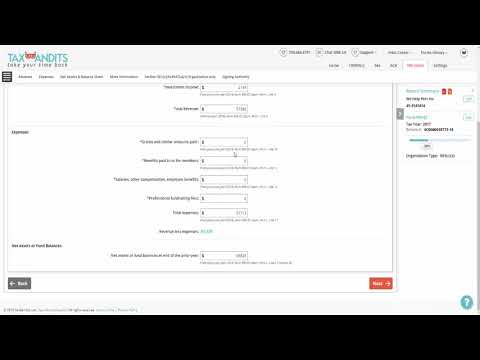

Welcome to Tax Bandits, the official platform for filing taxes for small businesses and nonprofit exempt organizations. If your organization has gross receipts less than $200,000 and total assets less than $500,000, you are required to file a Form 990-EZ. Once you have logged in, please proceed to enter your exempt organization details, such as your organization name, employee identification number, and address. It is important to note that the organization name and EIN must match exactly as they are recorded by the IRS. Next, select the tax year for which you are filing the return. Be sure to check any additional questions if they apply to your organization. Then, select your organization's formation date and the state in which your organization operates. On the following page, select your organization's current tax-exempt status based on the registered type. If you are a 509(a)(3) supporting organization, please choose yes or no. This information is mandatory as it helps us determine which form is best suited for you to e-file. Next, provide your group return details if you are a member of a group exemption. Only choose yes if you are a central or parent organization and use 990 forms to file on behalf of your subordinates in a group exemption. Now, select the gross receipts and accounting method that best describes your organization. This will further assist us in determining the appropriate 990 Series form for you. After that, choose between being a public charity or private foundation to define your organization. Provide the required information about your charity and support status. If you have more than one public charity status, you must answer the following additional questions before proceeding to file Form 990-EZ. Once you have inputted all the necessary information, please review carefully and ensure that your details are accurate. If any changes...

Award-winning PDF software

Irs 990 ez instructions Form: What You Should Know

See the instructions for additional information. Important Notice. IRS may not always receive the return you want. Fiscal year ending March 31. April 15 is added to this date to avoid any conflicts with your tax return for prior quarters. Form 990 for Small Entities (EIN: 74-284784): IRS Public If an organization isn't required to file. A summary is required, but an additional return is not required; the summary must be provided to the IRS (and sent to all other taxing authorities) within 30 days if there is any information to amend Inst and/or Form 990-EZ (Sch A), Instructions for Schedule A (Form 990-EZ), Public Charity Status and Public Support, 2025 ; Form 990 or 990-EZ but does not provide a detailed financial statement; IRS receives the return on a form other than Schedule A 2021 Instructions for Schedule A (Form 990EZ), Public Charity Status and Public Support; IRS 2021 Instructions for Schedule A (Form 990) — IRS Public Charities. For the purpose of section 7546(g) of the Internal Revenue Code, a public charity is any organization described in section 501(c)(4) of the Internal Revenue Code, other than an organization described in section 501(c) for which the organization doesn't file a tax return. Public Support. Section 7546(h) of the Internal Revenue Code requires that an organization's support be publicly displayed in order for the support to be public assistance. Public Charities. Form 990 must be sent to: Public Charity Report (including Form 990-EZ and Schedule A of Form 990) 2021 Instructions for Form 990–EZ or Schedule A 2021 Instructions for Form 990 (Sch M), Public Charity Statement Instruction for Form 990, Schedules A, B, C, D, E, F, G; Schedule K; and Form K-1, Statement of Activities Public Charity Statement. Section 7546(h) of the Internal Revenue Code requires that an organization's support be publicly displayed in order for the support that would otherwise be considered to be public to be classified as the public giving of assistance to a public charity. 2021, Instructions for Schedule A, Public Charity Statement Public Charities.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IRS-990, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form IRS-990 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IRS-990 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IRS-990 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 990 ez instructions