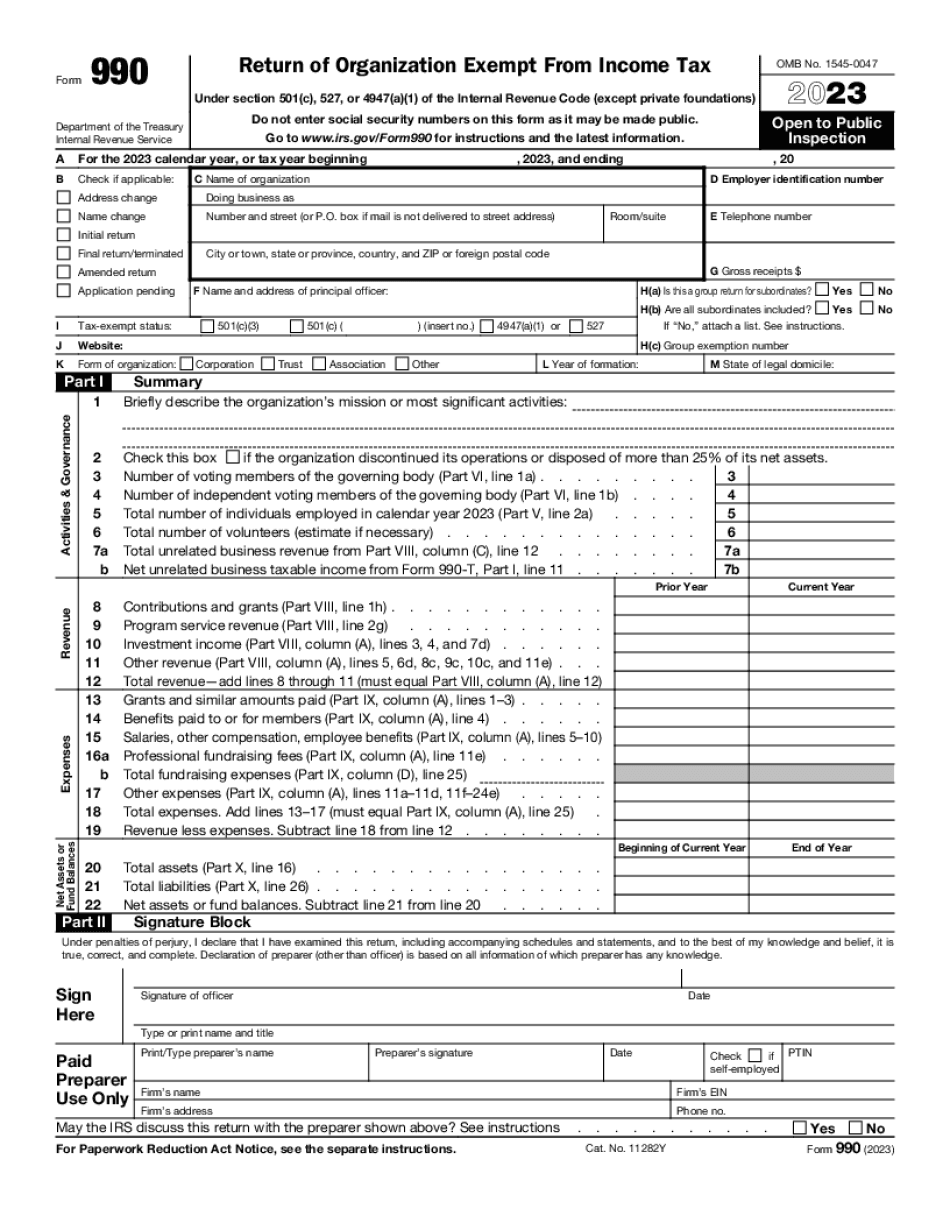

Irs 990 Form 2023-2024

Show details

Hide details

U made these available. Year and that the transaction has not been reported on any of the organization s prior Forms 990 or 990-EZ current or former officers directors trustees key employees highest compensated employees or disqualified persons If Yes complete Schedule L Part II. Affiliates and branches to ensure their operations are consistent with the organization s exempt purposes 11a Has the organization provided a complete copy of this Form 990 to all members of its governing body before ...

4.5 satisfied · 46 votes

irs-990-form.com is not affiliated with IRS

Filling out Form IRS-990 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form IRS-990

Every person must report on their finances on time during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form IRS-990, our reliable and intuitive service is here to help.

Follow the steps below to Form IRS-990 quickly and efficiently:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Complete your document using the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or delete unwanted file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal document delivery.

Select the best way to Form IRS-990 and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 990?

Form IRS-990, Return of Organization Exempt from Income Tax is one of the frequently used tax forms. Most nonprofit enterprises are required to file an income tax returns to IRS on annual basis.

Such form provides IRS with details about organization`s activities for previous fiscal year and always has to be submitted on time.

Information included in such form may be also disclosed to the public and prit with financial details related to a nonprofit organization.

Take a note that if an organization fails to submit a form during 3 fiscal years, the IRS has the right to revoke its tax-exempt status.

There are several types of this form, so, in order to choose the needed one it is necessary to define the organization`s annual gross receipts first. Such form may be filed electronically or send by regular mail.

We offer you to fill out an up-to-date blank IRS-990 Form in pdf online and submit it to the recipient. In order to customize a document according to your requirements, download an editable sample and use the variety of editing tools provided. If required, a form can be easily shared with recipients online or printed.

IRS-990 is divided into twelve parts. Start filling out a form with summarizing an organization`s mission or most significant activities. It is necessary to prdetailed information regarding organization`s expenses and revenue including all grants, benefits, investments, salaries paid out etc. Finish a document with reconciliation of net assets.

Remember to fill in all mandatory fields in a document. After a form is completed, check if all data provided is true and correct.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form IRS-990?

I filed an 890E DOG I, I.R.C., and Form 1040-ES. The Form I.R.C. is what tax filing and paying my taxes are all about. It says “Form” in the Title. The Form 1040-ES form is used for all payments of taxes and is a document most other people have seen. I want to pay the taxes online using the Forms. And my I.R.C. says to make the payments of a Form 1040-ES and a Form 990-EZ which I have not signed. So how do I do this?

I have read about the Form IRS-990 before and I would like to pay my taxes online using that. Here is what I have been told is that I should use Form IRS-990. What I don't understand about the Form is I am confused. It says “Form”, but it has an asterisk and a slash and that is it. So what is that and what does it mean?

Many times what I hear is that people are confused because they have found that Form IRS-990 is not available in their state. That doesn't make sense for many reasons.

In addition to reading about the Form 1040 (I have never filed a 1040) or the forms you may find on an Internet search, I thought I would give some suggestions here.

First, don't get confused by the word DOG. Zogle-I-C. Form 1055. Is that one of the 1055s? ZOG-1055 (Zig-Zag-Gag) or ZOG-1055 is an abbreviation for “DOG Tax on Gross Income Gives 1055,” according USA Today. DOG (Big Tag Gag) is an abbreviation for “zombie legislation.”

I also find it fascinating that Form ZOG-1055 is not available in California at all. You might think that is because California has very progressive taxes. I have read reports about how California has a regressive income tax, but I am unable to find any actual links to actual information about California. I am willing to bet if you actually search California you will find that some tax information just does not exist. The one thing you will find about California is that it has some of the most progressive taxes in the world. It means that if you make a lot, you pay a little.

Who should complete Form IRS-990?

If you are a U.S. taxpayer who is due a refund, you should complete Form 8442, Application for Refund.

If you anticipate needing less than 1,000 in tax refunds but also believe you will need more than this amount because of unusual circumstances (for example, that you or family members have been living outside the United States), you may need to complete Form 8442T, Application for Withholding U.S. Taxes Due to Taxpayer in Relation to an Inconvenience, to request more than 1,000 in refunds.

If you believe that you will need more than 1,000 in refunds because tax refunds cannot be expected immediately, you can complete the Form 9035-S, Application for Additional Tax Refund, if you have not filed a Form 8442, Application for Refund. If you file Form 1040X and have a personal exemption, you or your spouse can complete Form 8452S, Application for Withholding of Additional Tax by Spouse or Dependent, to request up to 11,000 of additional tax.

If you are a nonresident alien taxpayer or an alien from countries with special tax rules, including the Republic of China and China, Guam, the Northern Mariana Islands, Puerto Rico, and U.S. nationals filing a joint return with a U.S. citizen, you can file Form 8851, Application for Withholding of Tax on Certain Unearned Income or Information Returns. (You must certify that you are filing a joint return with a U.S. citizen.)

If you have a personal exemption, and you have a higher than normal expected refund, you can either file Form 8442T or Form 8851, depending upon the amount of your expected refund.

A complete schedule for claiming and applying for the credit is described in Publication 17, Withholding of Tax on Income, Benefits, and Social Security, and Form 4797, Claims for Refund of the Shared Responsibility Payment (SRP).

Are there special tax consequences if I do not file?

The special tax consequences described in the preceding two paragraphs (b) and (c) are applicable even if you file the Form 8442, Application for Refund.

Where to mail Form 8442

Form 8442 is required for filing and the refund due. You should mail Form 8442 to:

Internal Revenue Service

Department of the Treasury

P.O.

When do I need to complete Form IRS-990?

If you have already filed or paid the taxes you are due, the form should be complete and ready for electronic filing. If you need to update or change records, contact your federal, state or local tax authority to ensure that you have the required information.

To see if you have a pending tax return, check your Electronic Filing Information.

How do I file Form 990-A?

If you have an IRS 990-A form from the past five tax years, you can electronically file that form electronically online or by downloading the Form 990-A template and completing a completed Form 990-A form. This form is also available in paper form (Form 990-T) and on our Forms and Publications page.

For additional information about completing Form 990-A, see our guide to filing Form 990-A (Taxes) and our Form 990-A Instructions.

How do I electronically file Form 990-T?

You can electronically file a Form 990-T with an electronic filing system by using either of the following methods:

You can send the electronic filing system an electronic or paper Form 990-T using the “Electronic Filing with an Electronic Filing System” option on the Submit button box. Use the electronic filing system's website to submit the form electronically.

If you're using another software or operating system to submit the form, enter the information correctly.

The IRS has an online electronic filing service for returns due on or after January 2009, including the form 990-J.

When do I need to complete Form 990-T?

The electronic filing system accepts online Form 990-T electronically filed with a deadline of September 10, 2018. We expect to receive electronically submitted Forms 990-T no later than March 31, 2019.

How do I file Form 990-T?

To file electronically with the electronic filing system, log into the system by visiting the IRS website at. Use the button labeled “Forms & Publications” to learn more about how to file your Form 990-T.

A paper Form 990-T may be filed electronically using a tax preparation software program. You will need to print the form from your computer.

Can I create my own Form IRS-990?

Sure, we support Form IRS-990 for personal use only. However, if you really wanted to, you could create your own Form IRS-990. You can use the free online IRS 1040 form tool for a personal income tax return by using the instructions to create your own tax return. Once you have created your Form 990 using these instructions, it will print directly to a CD-ROM, CDR or USB device for print.

How do I create my new tax return using my new Form IRS-990?

If you have any questions or concerns, we would be happy to discuss your specific tax situation in our online chat.

More Tax FAQs

Can I use my credit card or loan to pay tax?

If you want to use a credit card to pay tax, it's better to make an advance payment.

Can I pay my tax by check?

Yes, but there are many advantages to mailing a check.

If my tax return arrives after I've reported it, can I get a refund?

No, if you file your tax return within 60 days of receipt, you have 30 days to request a refund. Failure to do so may result in a penalty of 25 percent of the tax amount, plus applicable interest. However, any refund paid within 30 days may be reduced to the least of three months interest or the original tax amount.

If you received a payment in error, or you didn't receive a payment, you may request a refund of your payment and any interest and/or penalties, in writing by mailing us a written request with your completed Form W-2, W-3 or IRS Form 1099-MISC and supporting documents with the proper payment documentation, too:

Department of the Treasury

Internal Revenue Service

P.O.

What should I do with Form IRS-990 when it’s complete?

If the Form IRS-990 is completed in accordance with the instructions it will automatically be forwarded to the appropriate agency for action and processing. It is important to note that the IRS provides no guarantees that an individual or company will be selected for the relief granted under Form IRS-990. In addition to completing Form IRS-990, we advise that you contact IRS Customer Service to obtain information on your specific situation to determine your individual potential eligibility and the IRS' response. If you are under the age of 18 at the time Form IRS-990 has been filed, you can request that we add a notation of “Under 18” on the Form IRS-990. This request will be handled on a case-by-case basis to determine if you are eligible to receive a refund. If you received a notice in the mail after the time that it took to complete Form IRS-990 and you cannot locate where your Form IRS-990 is, you should contact IRS Customer Service.

Is my Form IRS-990 tax-exempt?

Form IRS-990 is not tax-exempt. The IRS is not liable for any tax liability incurred by a taxpayer who has filed an IRS Form RR-2 or equivalent with the IRS, or by anyone who has filed a Form RR-3, RR-4, RR-5, RR-6, RR-9, or RR-10 for which you have listed the same return information.

Form RR-2 and Form RR-3: What do they show?

Please see IRM 21.6.1.3.1.4.2, RR RR-2 and Form RR-3 (Forms RR), for a list of RR-2 returns.

Form RR-4 and Form RR-5: What do they show?

If you filed Form RR-4 or Form RR-5, or if you received a notice in the mail saying you are filing, you should provide a letter from your tax preparer that states the information you need to complete Form RR-4 or Form RR-5. We will use the letter as proof of service for Forms RR-4 and Forms RR-5. If your Taxpayer Identification Number does not appear on the cover page of Form RR-4 or Form RR-5, you should contact your preparer to request an original and duplicate Form RR-2 in the same manner as described above. You also may be able to use an attached tax return instead of using Form RR-2.

How do I get my Form IRS-990?

I filed a tax return and did not receive my Forms IRS-990. What do I do?

If you filed a tax return and have not yet received a Form IRS-990, please contact the IRS directly to request that we send you one.

You can either send your Form IRS-990 directly to the following address:

Internal Revenue Service

Internal Revenue Service

Office of the Chief Counsel

U.S. Department of the Treasury

P.O. Box 942740

Washington, DC 20

Or you can mail in your Form IRS-990:

Internal Revenue Service

Post Office Box 942740

Washington, DC 20

Do I need to file a “1098x”?

You can receive a free 1098X after filing a federal tax return.

If the IRS has sent you a 1098X after filing a tax return, then you can use that form to file your own state return.

If you have not received a 1098X after filing a tax return, then you must file your state tax return.

I have filed my 1090-EZ and received a 1098X. What do I do?

You should file your state income tax return directly, or file and attach a copy you have of the 1098X. Your state income tax return should summarize each taxable year of income and expenses, and list all other income that you received.

If you have filed both a 1090-EZ and a 1098X, then your filing status should be either “Alimony” (meaning alimony payments do not exceed your adjusted gross income) or “Non-payment of child support” (meaning you do not have a current state child support order).

What are the rules for filing an amended return?

An amended return is filed within three months of the due date. The tax return is filed using the applicable “paper form” (e.g., Form 1040, Forms 1040-EZ) and, if applicable, the appropriate state tax return. For state tax returns, you can view and print copies of the forms by obtaining tax forms for your state from the IRS online.

If you have filed your tax return electronically, then you may need to file a paper IRS form called an “Additional Return Form or Form W-4” (Form W-4).

What documents do I need to attach to my Form IRS-990?

Please refer to Form 8802 and the instructions on page 15 of the attached Schedule A. I am filing Form 8802 as part of a plan that qualifies. I am filing it under the plan of the employer who paid the unemployment compensation claim, rather than the claimant. I am filing a joint return. My spouse has filed a joint return with me. Do I file a joint return, or am I required to file a separate Form 8802? When filing Form 8802 if the amount being paid in excess of Federal Unemployment Tax Act (FTA) benefits is 3,000 or less, and the employer was the employer of the employee for all or part of the year, and the employee had a valid right to receive benefits, you must file an individual return. For more information in regard to how to report the amount over 3,000, which is not covered under the FTA, you need to refer to Publication 590-B. When the amounts to be reported on Form 8802 exceed 3,000, you need to file an individual return (Form 8802A) and attach a Statement of Estimated Tax, Form 1040, as well as any other returns required if you are required to file Form 8802. You will see a separate statement of estimated tax for each employee for whom you are filing a joint return. Do you have to file Form 8802 if, for the part of the year during which you were not the employer, the employee did not have a valid right to receive benefits? Yes. The employer must file Form 8802A or Form 8802, whichever is less. I am filing a joint return. Does my spouse have to file Form 8802 when we file our individual returns? Unless you have a valid right to receive benefits, your spouse need not file Form 8802. How do I file Form 8802? Please refer to the form in attachment (p. 9) of schedule A included with your Form 8802 for the filing and mailing instructions, or to the instructions given by the IRS in the attachment to Form 8802, “Individual Form of Form 8802A”. We must have the following information on our tax return (Form 8802) and payment for benefits by paper (not by electronic transfer through the automated systems) when we file our return. The name and address of the corporation where the claimant worked. The name and address of the claimant's employer.

What are the different types of Form IRS-990?

Form 8283 is a tax return and Form 1099-INT is an income tax return. The IRS is also issuing these documents to merchants. For more information about your tax issues and the forms available, see Forms You Need to Know for Merchants.

How many people fill out Form IRS-990 each year?

According to a study in 2006 by the National Conference of State Legislatures (CSL), between January 2009 to January 2013, the federal government issued 651,979 applications for tax-exempt status. As of January 2014, they'd collected more than 2.7 billion in “income tax and withholding” receipts through that process alone.

When will the IRS finally start sending out notice letters to the filers (to let them know that they have been issued a notice to pay)?

Not if the IRS gets its way. The IRS, as a government agency, needs to be seen as transparent. They would rather have you pay taxes, and then send out a notice than to make you pay taxes, let them send you a notice, and then send them money. But if they want to have more money (i.e., for more auditors), then they'd rather be pay the tax bill now and then start sending out actual notices later.

According to a 2008 House Report, the IRS has already received more than 2 million applications for non-profit tax status between January 1, 2008, and April 4, 2008 (a year which, coincidentally, was also when they instituted their new requirement that they use the personal tax ID numbers to track the filings).

So if a federal agency that collects such a large amount of income and then sends out a relatively small number of notices to pay that tax, is the system somehow failing if it never processes a single Form IRS-990?

It's certainly not a failing, given that this is the law. This is, after all, the point of the IRS tax process: to make tax evasion as bad as possible while giving the illusion of compliance. It worked.

But it's a bit silly for them to do it that way, too. For decades, the IRS had no problem using non-identifiable information to identify individual taxpayers. They were so confident about the legitimacy of their system that they could have legally used that technique to identify every single taxpayer who actually paid taxes, which isn't likely at all. I know because I used it, and it worked.

Is there a due date for Form IRS-990?

The IRS may issue Form R990 by the due date stated on the Notice of Electronic Filing if it determines that you have met the due date.

What if I have to fill out both the Notice of Electronic Filing and the Form IRS-990?

If, after you have completed both notices, you still need to file form return for the tax period in which those notices were issued. The IRS determines the due dates based on the date you filed the tax return, unless one or more of the exceptions below apply. For example, the notice of electronic filing applies even if you make an electronic payment from the IRS or a third party.

If only some Notice of Electronic Filing will apply:

It is best to file your return before the due date. In this case you'll need to determine if there are other tax payments due or exemptions of interest. If you filed on time and have some Notice of Electronic Filing, you must include the required information on Form 1040-EZ when you file your return and pay your tax liability.

If both the Notice of Electronic Filing and Form IRS-990 will apply to get past the date on the Form 6251/6252 (which is the date of issuance), then the best way to avoid the additional filing fees and penalties as described in section 5, is to file the returned Form 6251/6252 by the Due Date. Note that the form must be filed by the Due Date.

Where are the rules for filing and paying any applicable taxes if you file electronically?

When filing your return through IRS e-file. You will see the following notice if you need to file more than one tax return or payment:

“Your Taxpayer Identification Number (TIN) or taxpayer identifying number (TIN-LTN) was not found to apply.” You can review our instructions to assist you.

For more information, see Instructions for Taxpayers Filing Form 6251 or Form 6252 and Processing the Electronic Filing Assistance Request (EFR) Application.

Do I need to provide my current TIN on my e-file application when filing using Form 6251?

Your current TIN should be entered on your e-file application form when filing using electronic filing. You do not need to enter the TIN on your actual return. For more information see How to Make an Electronic Filing Agreement.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here